What is SMB Compass?

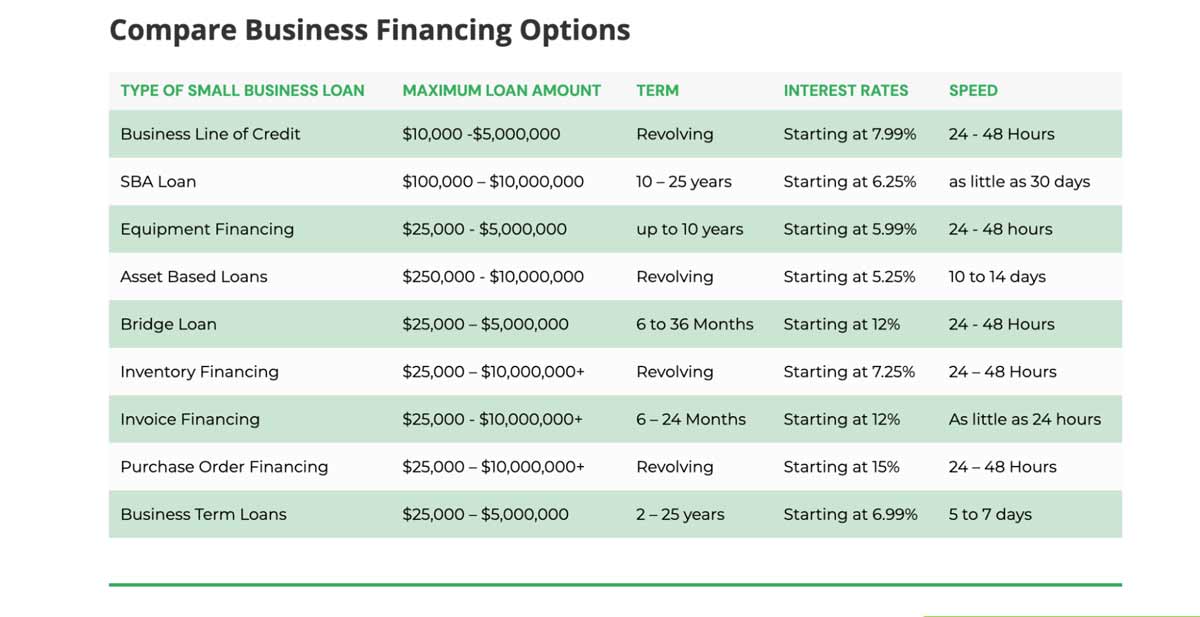

SMB Compass provides a wide range of small business loans up to $10M, including term loans, line of credit, SBA loans, equipment financing, asset-based loans, bridge loans, inventory financing, invoice financing, and purchase order financing.

Each loan carries different requirements, but most require one year in business and, at minimum, a credit score of 600. The guidelines for each loan type are laid out and transparent on the SMB Compass website.

Financing options available at SMB Compass.

Regarding payment terms, SMB Compass generally requires repayment terms of six months up to 25 years. We were pleased to see that starting interest rates for each loan type are laid out on the website. While it can take up to a week for approval, once approved, you will receive funding within 24 hours.

In addition, SMB Compass offers small businesses an extensive range of education around different lending and financing topics through an online financing basics guide and informative blog.

Educational blog and information are shared to empower business owners in their financing journey.

Is SMB Compass legit?

SMB Compass has 25 years of experience in commercial lending. They’ve helped over 1,250 small businesses secure a combined $250M in funding. SMB Compass is a dedicated lender, proven by the fact that many clients become friends and return customers. They are committed to providing business owners with the information and the education they need to make informed decisions on their financial options.

Get Started Visit SMB Compass’s website.

SMB Compass loan requirements

SMB Compass loans require at least 12 months in business to qualify.

- Time in business:

- 12 months

- Annual Revenue:

- $20k per month

- Credit Score:

- 600

| SMB Compass Lender Details | ||

|---|---|---|

| Loan Amounts | Time to Funding | Repayment Terms |

| Up to $10M | 24 hours | Up to 25 years |

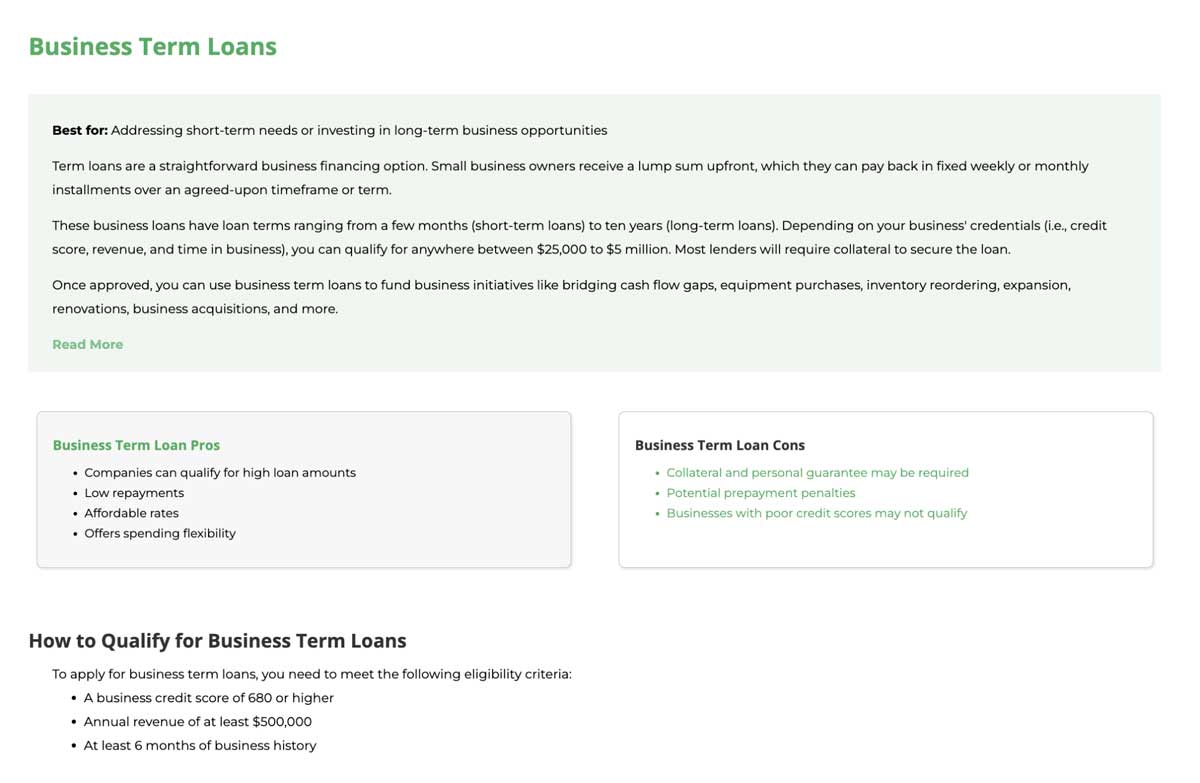

What does SMB Compass offer?

| Business Loan Features | |

|---|---|

| Term loan | |

| SBA loan | |

| Line of credit | |

| Invoice financing | |

| Working capital loan | |

| Merchant cash advance | |

| Equipment financing | |

Other notable SMB Compass features

- Bridge loans

- Asset based loans

- Inventory financing

- Purchase order financing

- Flexible payment options

- Education tools

- Quick business loan option

- Loans by state

- Loans by industry

Get Started Visit SMB Compass’s website.

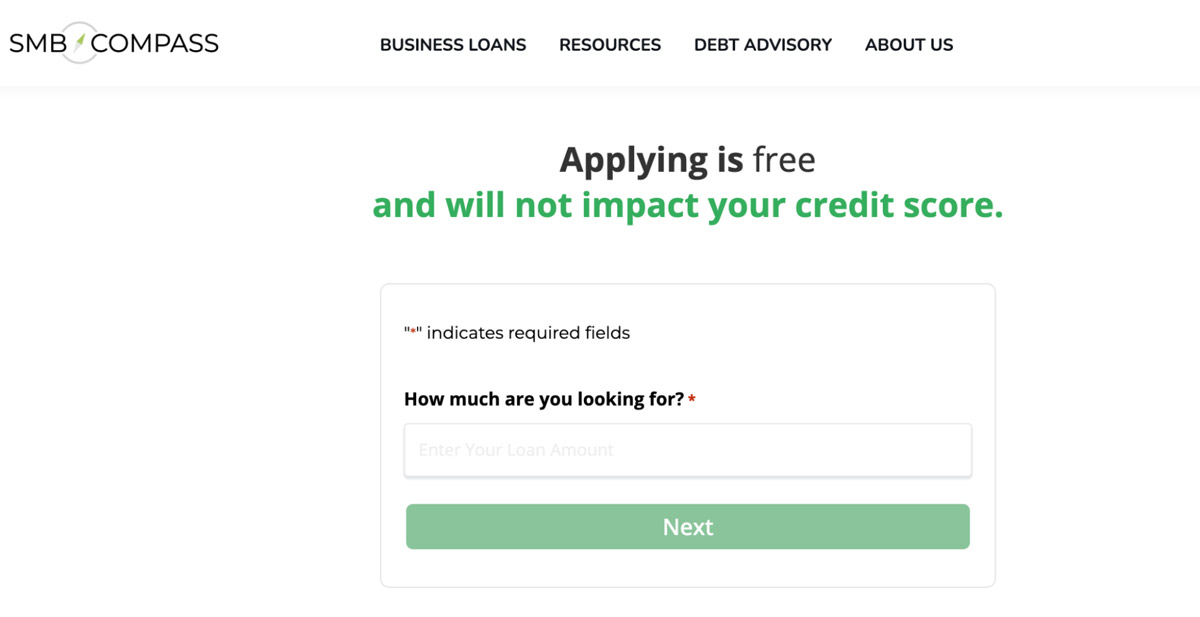

SMB Compass application process

You can apply for a loan with SMB Compass online or by phone.

You will need the following information to apply for an SMB Compass business loan:

- Quick one-page online application

- Information on your business’s financial health and creditworthiness

- Specific requirements vary by loan type

SMB Compass Customer Support

| New Customer Phone | 888-853-8922 | |

| Existing Customer Phone | Not available until approval | |

| Customer Support Email | info@smbcompass.com | |

| Chat | Available | |

| FAQs | Available | |

| Knowledge Base | Available |

Detailed information about each loan type is available on SMB Compass’s website.

SMB Compass user review highlights

One of the foundations of SMB Compass is its relationship-building and ability to turn customers into friends. We have found this true in all the reviews we sifted through. SMB Compass excels at building relationships, becoming a lending partner, offering helpful resources, and becoming a true friend to the businesses they serve.

The only remotely negative remark we read is that the rates can be high. The following further summarizes the customer reviews we studied.

- Application Process – users say the process is fast and efficient.

- Ease of Use – customers appreciate the available resources that help them understand their financing options.

- Features – every review mentions how knowledgeable, helpful, and amazing the customer support is.

- Quality of Support – not only is the customer support knowledgeable, prompt, and helpful, but users are amazed at how SMB Compass representatives really dig in and learn about their business, enabling them to make custom lending suggestions and, in many cases, save money.

- Convenience – most users who have worked with SMB Compass turn into repeat customers, finding them the only place to consider when it comes to business loans.

SMB Compass Contact Information

- Parent Company:

- SMB Compass

- Headquarters:

- New York

- Year Founded:

- 2017

- Website:

- smbcompass.com

- Facebook:

- facebook.com/smbcompass

- Twitter:

- twitter.com/CompassSmb

- LinkedIn:

- linkedin.com/smbcompass/

- Instagram:

- instagram.com/smbcompass/

- YouTube:

- youtube.com/UCRXD1SxVqFvwoIPCIQqJOLA

SMB Compass alternatives

| Lender | Loan Amounts | B2B Reviews Score |

|---|---|---|

| SMB Compass | Up to $10M | 5 |

| Funding Circle | Up to $500k | 4.5 |

| Biz2Credit | Up to $2M | 4.8 |