What is QuickBooks Payroll?

Intuit QuickBooks Payroll is an intuitive payroll software that streamlines and eliminates the time you spend processing payroll. The program allows users to set up automatic payroll runs, calculates and files federal and state payroll taxes, and enables you to offer competitive employee benefits.

If you already use other QuickBooks software, you will find that QuickBooks Payroll integrates smoothly with all other QuickBooks programs. But as with large programs, it prioritizes internal integrations above third-party integrations. The result, if you’re already a QuickBooks user, setting up QuickBooks Online Payroll will be a breeze. It will intuitively set up and integrate with your already existing QuickBooks programs. That said, users new to payroll software and QuickBooks report a big learning curve. If you run into an issue, there is a wealth of online knowledge through the QuickBooks Payroll tutorial to answer any questions.

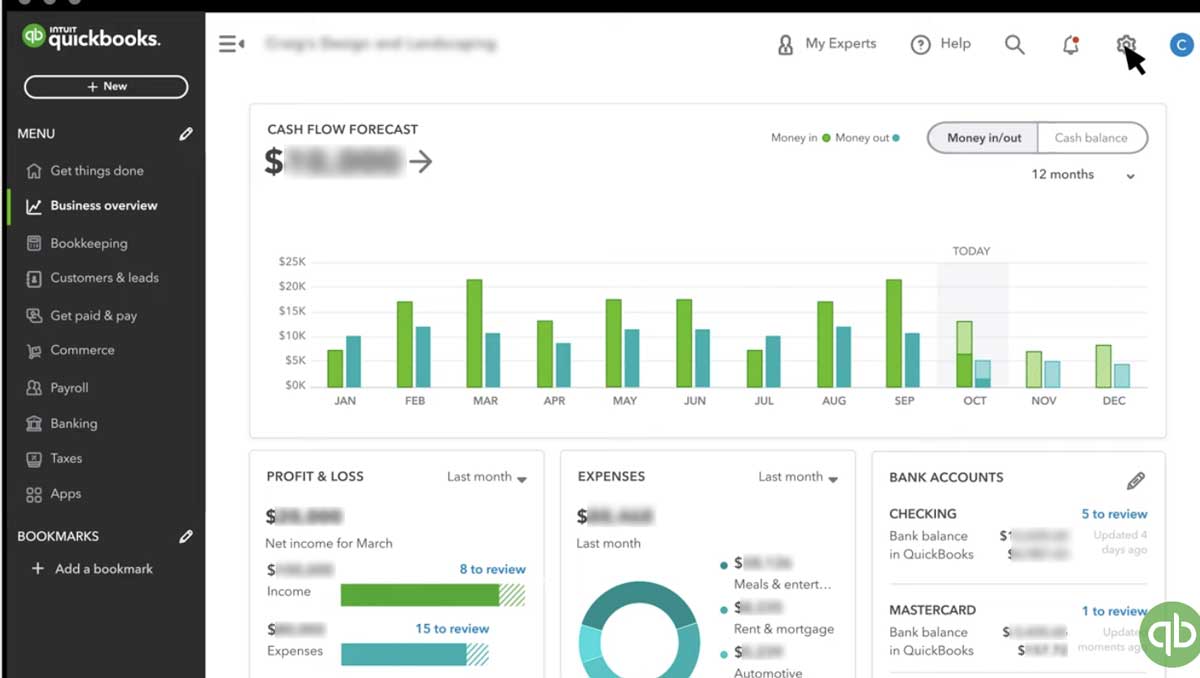

The QuickBooks Online Payroll dashboard gives you an overview of your business financials. Source: QuickBooks Support

There are three plans that allow you to bundle payroll and bookkeeping together and three more cost-effective plans for just payroll: Core, Premium, and Elite. You get automated payroll runs, direct deposit, and basic product support, even at the most basic level.

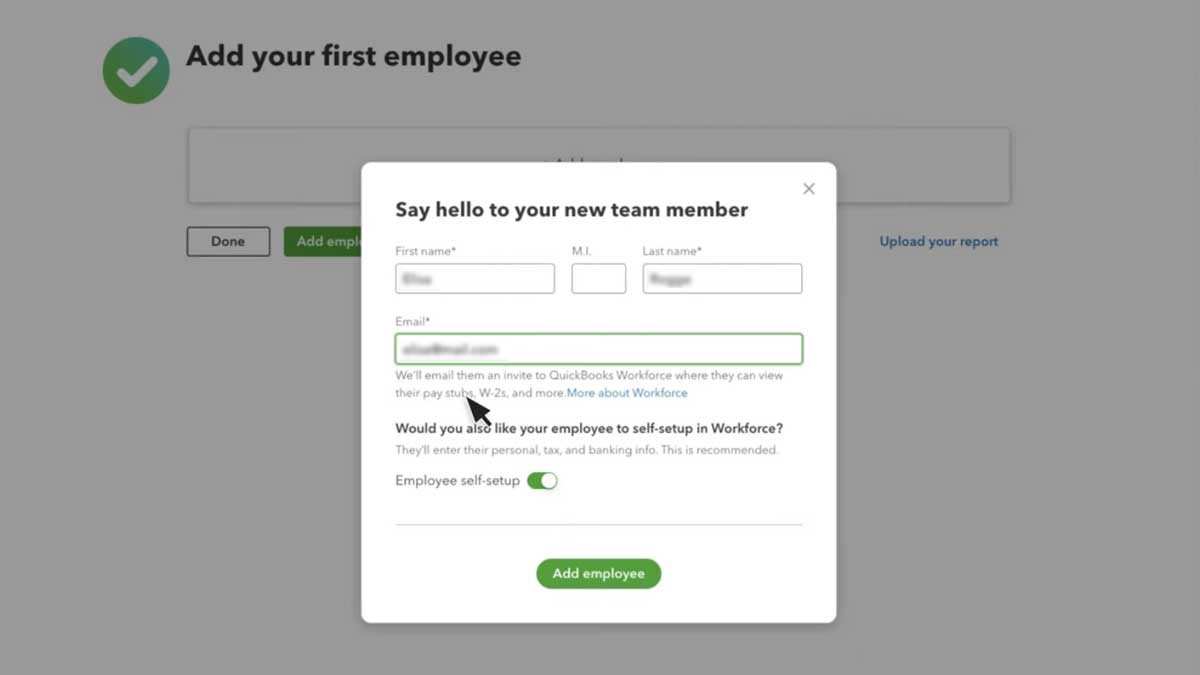

Invite employees to QuickBooks Workforce so they can enter their personal info, view pay stubs and W2s, and more. Source: QuickBooks Support

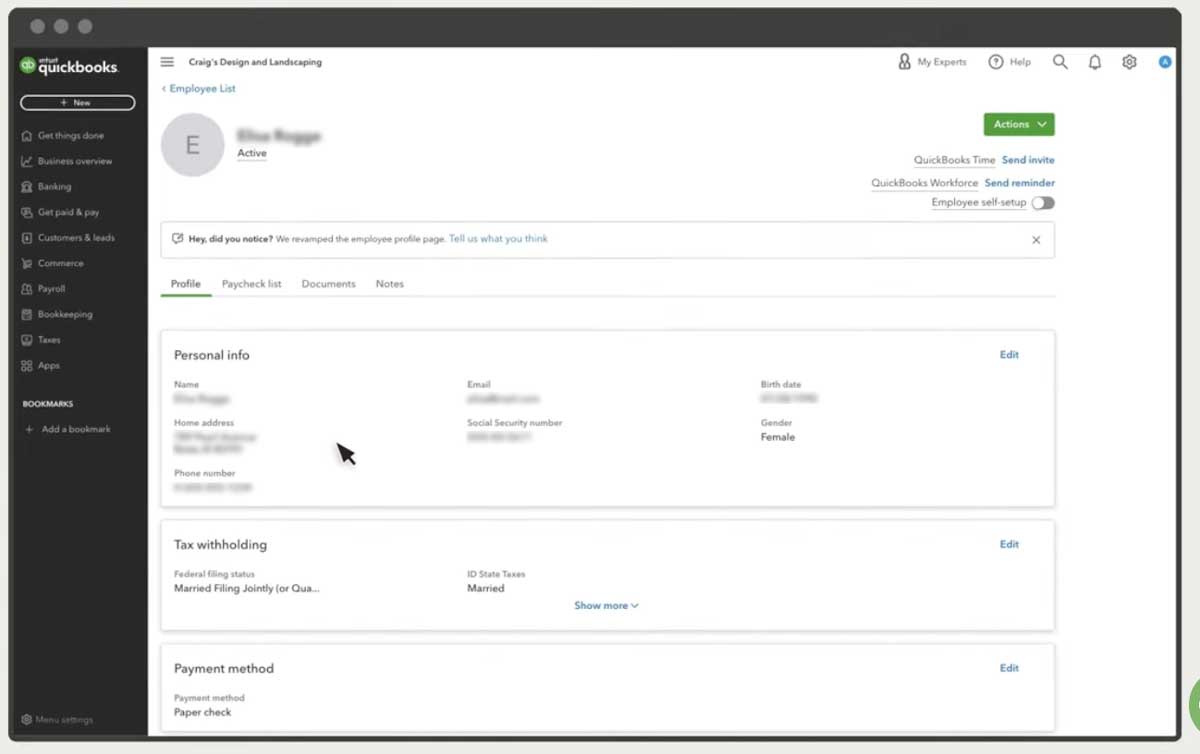

Setting up a new employee in QuickBooks Online Payroll is easy and intuitive. Source: Quickbooks Support

Get Started Visit Quickbooks’s website.

The QuickBooks desktop payroll subscription offers opportunities to add on features like HR assistance, 401k plans, employee benefits, and workers’ compensation. In QuickBooks Payroll reviews, users find that it simplifies the payroll process freeing up time to focus on other aspects of the business.

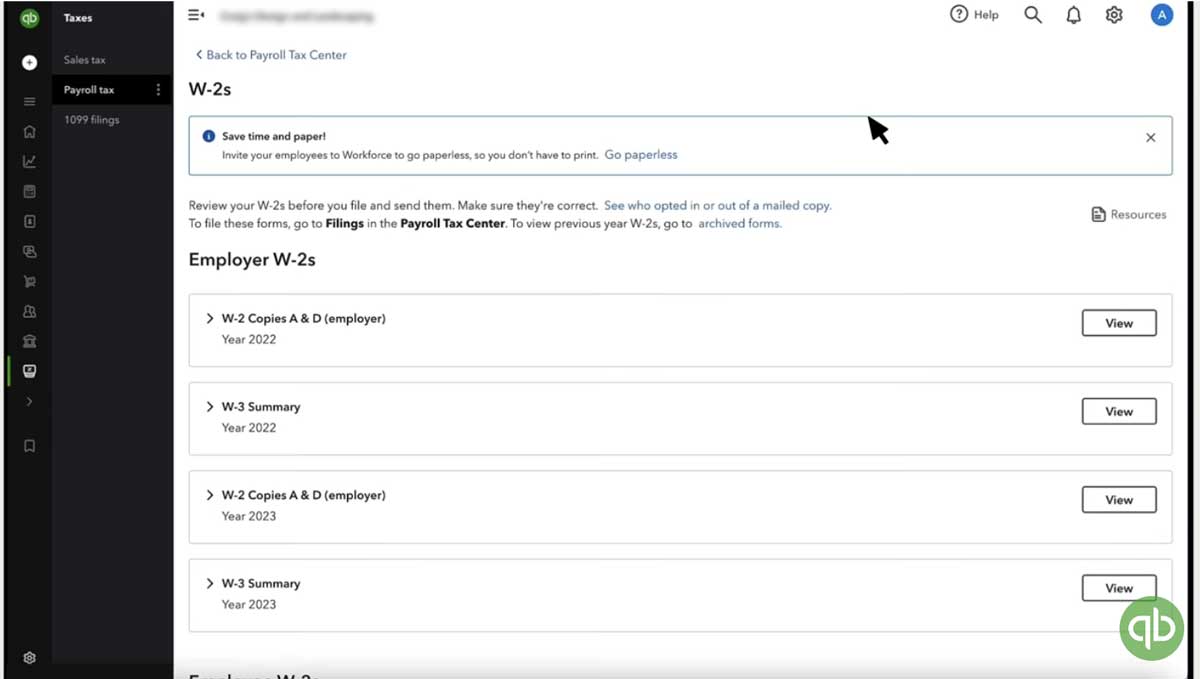

With QuickBooks Online Payroll, it’s easy to retrieve W-2s electronically or have paper copies mailed to your employees. Source: QuickBooks Support

Is QuickBooks Payroll legit?

Intuit was founded in 1983 with a product called Quicken for personal financial management. After its initial success, it quickly added business products under the line QuickBooks, which has grown to what it is today. While there are many pros and cons of QuickBooks Payroll, one thing remains the same – it’s well-known and well-regarded as a leading accounting and payroll program.

How much does QuickBooks Payroll cost?

QuickBooks Payroll plans start at $22.50/month + $5 per employee/month

- Starting price:

- $22.50 per month plus $5 per employee monthly

- Free trial:

- 30 Days

- Free version:

- Not Available

| QuickBooks Payroll Pricing & Plans | ||

|---|---|---|

| Payroll Core | Payroll Premium | Payroll Elite |

| Starting at $22.50 /mo | Starting at $37.50 /mo | Starting at $62.50 /mo |

| Plus $5 per employee per month | Plus $8 per employee per month | Plus $10 per employee per month |

What’s included in every QuickBooks Payroll plan? QuickBooks Payroll has three plans: Core, Premium, and Elite. You get a 50 percent discount on all plans if you are a brand-new customer of QuickBooks. The discounted price is the price reflected in this review.

In the QuickBooks Online Payroll Core plan, you get full payroll services meaning they calculate and file payroll taxes. You also get auto payroll runs, basic product support, and next-day direct deposit. When you move up to the QuickBooks Online Payroll Premium level, you get time tracking tools, same-day direct deposit, 24/7 customer support (through chat), and a payroll expert will review your payroll setup to ensure everything is correct. Finally, at the QuickBooks Online Payroll Elite level, you get an expert to set up your payroll, plus time and project tracking, a higher level of customer support, tax penalty protection, and an HR advisor.

Which features does QuickBooks Payroll offer?

| Payroll Software Features | |

|---|---|

| Next-day and same-day direct deposit depending on your plan | |

| Payroll tax filing | |

| Limited employee self-service is available such as address changes, marital status, and withholdings | |

| Integrates seamlessly with all QuickBook programs | |

Other notable QuickBooks Payroll features

- Tax penalty protection

- Discount for new customers

- Expert setup

- HR assistance

- Time and project tracking

- 24/7 customer support

- Employee benefits

- 401k plans

- Workers Comp

Get Started Visit Quickbooks’s website.

What types of support does QuickBooks Payroll offer?

| Data Migration | |

| 1-on-1 Live Training | |

| Self-Guided Online Training | |

| Knowledge Base | |

| FAQs/Forum | |

| Email Support | |

| Live Chat | |

| Phone Support |

QuickBooks Payroll review highlights

We analyzed 881 user reviews about QuickBooks Payroll from two third-party review websites to provide this summary.

QuickBooks Payroll reviews indicate a complex learning curve, and it’s a bit complicated to get set up. In general, it might be on the complex side for novice bookkeepers. QuickBooks online payroll reviews also report that the price is a little steep for small businesses, and some users report that the price goes up frequently. Furthermore, long wait times are reported when calling customer service.

Despite those initial gripes, Intuit QuickBooks Payroll reviews are pretty positive and report that after the initial learning curve, the UI is easy to navigate and use. Users also appreciate that it integrates so easily with all QuickBooks software, making it worth the money. Other features users are pleased with are the accurate time clocking and syncing with timesheets, the many customizations, the ability to track employees and what projects they’re working on, and how simplified the payroll and deductions process is.

- Ease of Setup – setup is problematic for some users who report a steep learning curve.

- Ease of Use – once setup is complete, ease of use is much better.

- Features – QuickBooks Payroll reviews list deductions, taxes, time tracking, and customizations as the best features.

- Quality of Support – while reviewers note that customer service representatives are friendly, the wait times are long, and sometimes it’s faster and more helpful to dig through the help files online.

- Value for Money – reviewers are split on value. Some report that it’s expensive, especially for small businesses, while other users say it’s a wonderful program that saves them so much time and hassle for the money.

QuickBooks Payroll Contact Information

- Parent Company:

- Intuit

- Headquarters:

- Mountain View, CA

- Year Founded:

- 1983

- Website:

- quickbooks.intuit.com/payroll

- Facebook:

- facebook.com/IntuitQuickBooks

- Twitter:

- twitter.com/QuickBooks

- LinkedIn:

- linkedin.com/company/quickbooks

- Instagram:

- instagram.com/quickbooks

- TikTok:

- tiktok.com/@quickbooks

- YouTube:

- youtube.com/c/Quickbooks

QuickBooks Payroll alternatives

| Software | Starting Price | B2B Reviews Score |

|---|---|---|

| QuickBooks Payroll | $22.50 / month + $5 per employee/month | 4.5 |

| Gusto | $40/month + $6 per person/month | 4.8 |

| SurePayroll | $19.99 / month + $4 / per employee / month | 4.7 |