What is OnDeck?

OnDeck is a small business loan lender offering term loans and business lines of credit. It is designed to grow with a business as they grow. It’s the only online lender on our list that offers loyalty perks that include waived interest on your current loan when it is 50 percent paid off and you renew your contract or take out another loan with them. The lender also waives interest and fees for qualified businesses that pay off their term loan early.

OnDeck is a small business loan lender offering term loans and business lines of credit. It is designed to grow with a business as they grow. It’s the only online lender on our list that offers loyalty perks that include waived interest on your current loan when it is 50 percent paid off and you renew your contract or take out another loan with them. The lender also waives interest and fees for qualified businesses that pay off their term loan early.

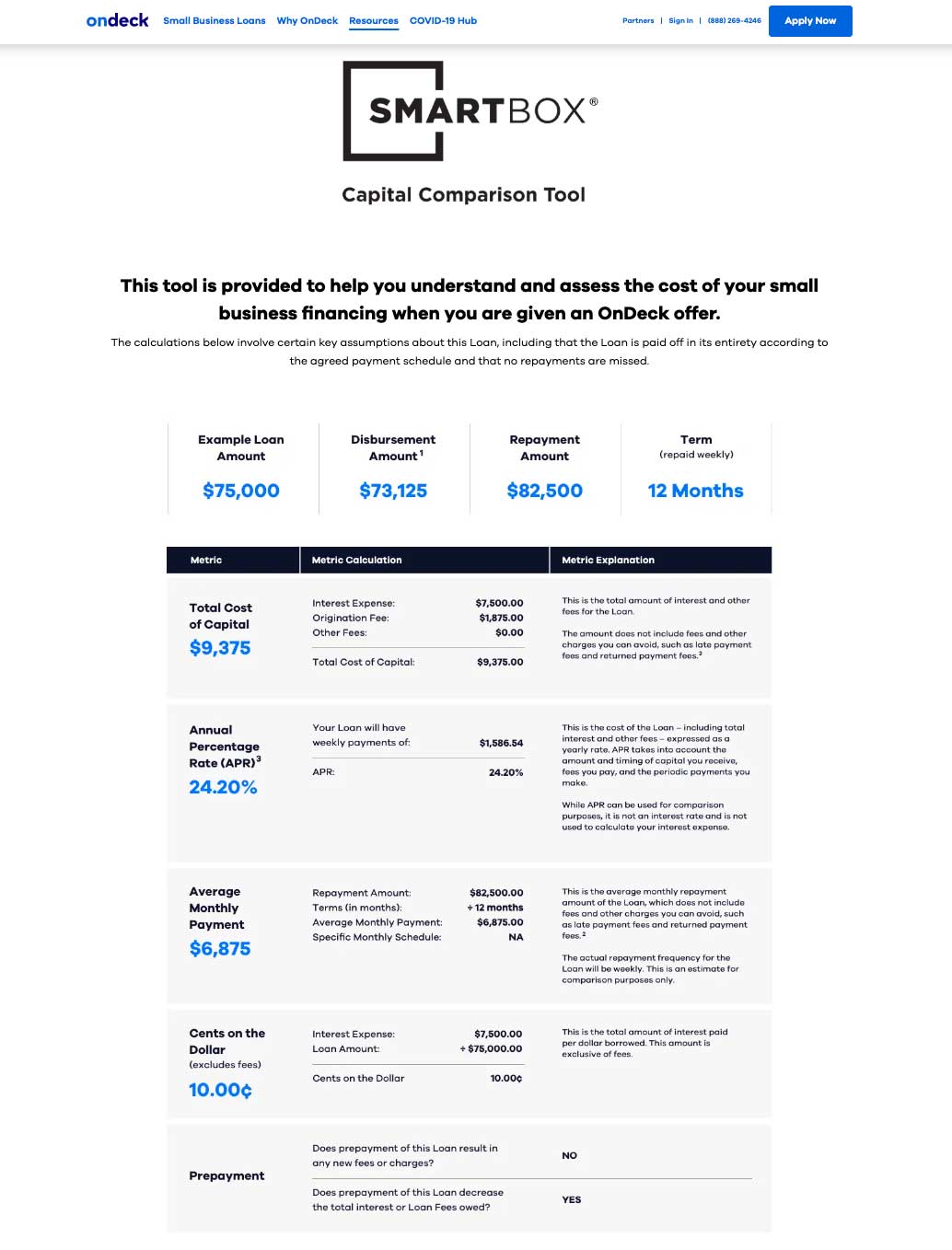

These metrics include APR, monthly payments, total disbursement amount, total repayment amount, and more, making it easy to understand your terms.

Best for Established Credit

SMB Compass

- Flexible repayment terms

- Large loan amounts

- Quick business loan option

Start Application Visit the SMB Compass website

OnDeck SmartBox comparison tool that breaks down your funding costs. Source: OnDeck website.

OnDeck loan requirements

OnDeck loans require at least one year in business to qualify.

- Time in business:

- 12 months

- Annual Revenue:

- $100k

- Credit Score:

- 625

| OnDeck Lender Details | ||

|---|---|---|

| Loan Amounts | Time to Funding | Repayment Terms |

| Up to $250k | Same Day | Up to 24 months |

What does OnDeck offer?

| Business Loan Types | |

|---|---|

| Term loan | |

| SBA loan | |

| Line of credit | |

| Invoice financing | |

| Working capital loan | |

| Merchant cash advance | |

| Equipment financing | |

Other notable OnDeck features

- Loyalty benefits

- Business credit building

- Prepayment benefits

- Predictable, fixed payments

- Transparent pricing

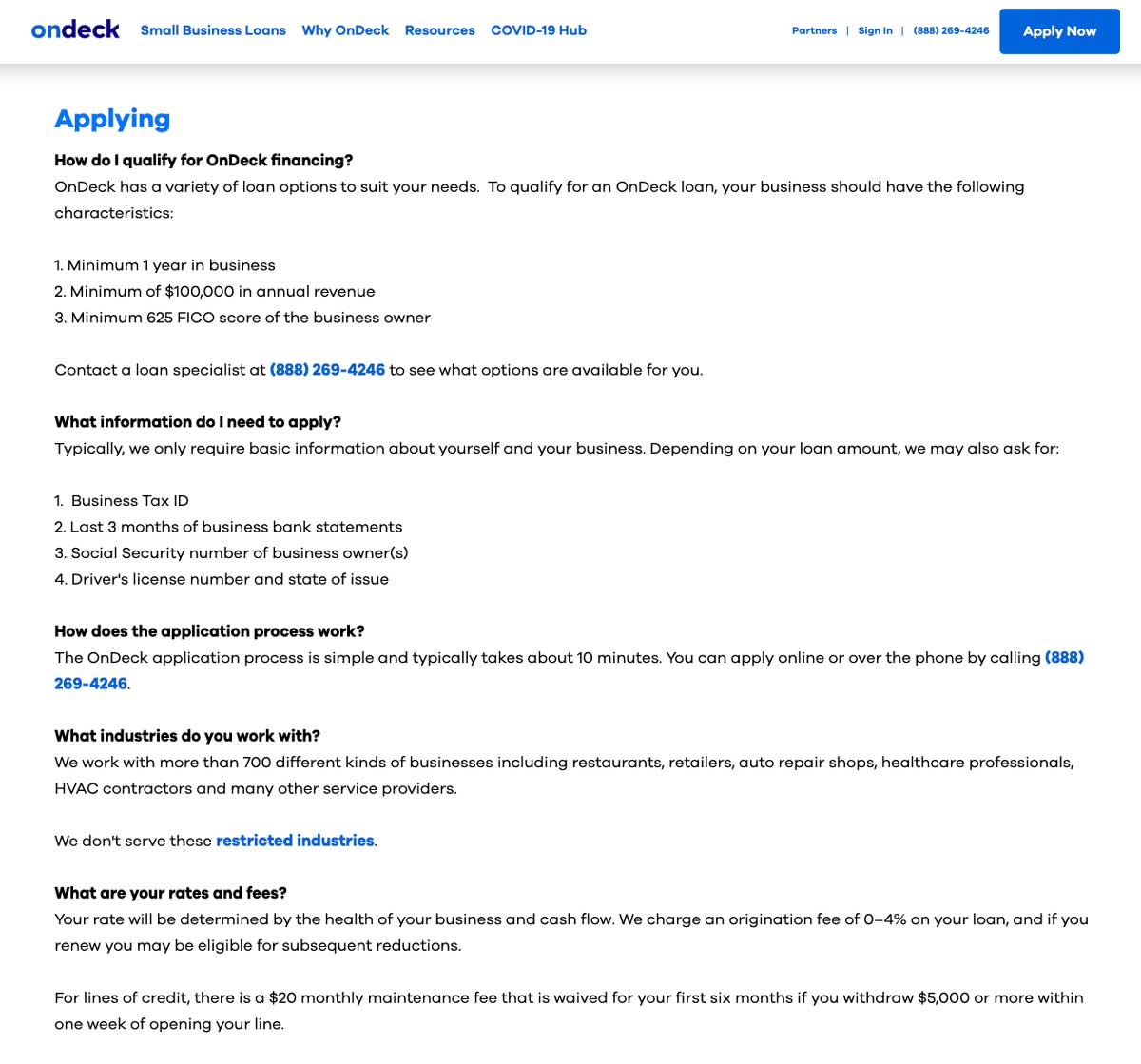

OnDeck interest rates, OnDeck fees, and application process. Source: OnDeck website.

OnDeck application process

You will need the following information to apply for an OnDeck business loan or OnDeck capital:

- Business tax ID

- Last three months of business bank statements

- Social security number of business owner(s)

- Drivers license numer and state issued

OnDeck Customer Support

| New Customer Phone | (888) 269-4246 | |

| Existing Customer Phone | (888) 556-3483 | |

| Customer Support Email | customerservice@ondeck.com | |

| Chat | Available | |

| FAQs | Available | |

| Knowledge Base | Available |

OnDeck user review highlights

We analyzed 3,707 user reviews about OnDeck from two third-party review websites to provide this summary.

Overall, most borrowers find OnDeck a quick and pain-free option. OnDeck reviews report the application process is minimal, the funding quick, and the representatives are very professional and helpful.

Some complaints surface in OnDeck business loan reviews regarding payment fees that were supposed to be waived or lowered not happening, and some users find pricing with OnDeck to be steep.

- Application process – Users find the application process easy, with minimal requests for documentation.

- Ease of Use – Most users say that using their OnDeck login to move funds around through the OnDeck platform is easy and responsive.

- Features – Users appreciate the loyalty benefits and repeatedly comment on the ease of application and quick funding.

- Quality of Support – Most reviewers find the OnDeck representatives helpful and professional.

- Convenience – If it’s quick funding you’re after, users say you will find it with OnDeck, but in turn, you might end up paying higher prices.

OnDeck Contact Information

- Parent Company:

- Enova International

- Headquarters:

- New York, NY

- Year Founded:

- 2006

- Website:

- ondeck.com

- Facebook:

- facebook.com/OnDeckCapital

- Twitter:

- twitter.com/OnDeckCapital

- LinkedIn:

- linkedin.com/company/ondeck

- Instagram:

- instagram.com/ondeckcapital

OnDeck alternatives

| Lender | Loan Amounts | B2B Reviews Score |

|---|---|---|

| OnDeck | Up to $250k | 4.25 |

| Biz2Credit | Up to $2M | 4.75 |

| QuickBridge | Up to $500k | 4.5 |