What is Funding Circle?

Funding Circle is on a mission to get small businesses the funding they need to win. They offer three types of loans: business term loans, SBA loans, and business line of credit. Merchant cash advances, working capital loans, and invoice factoring loans are available through Funding Circle’s network of lending partners but not directly through Funding Circle.

Best for Established Credit

SMB Compass

- Flexible repayment terms

- Large loan amounts

- Quick business loan option

Start Application Visit the SMB Compass website

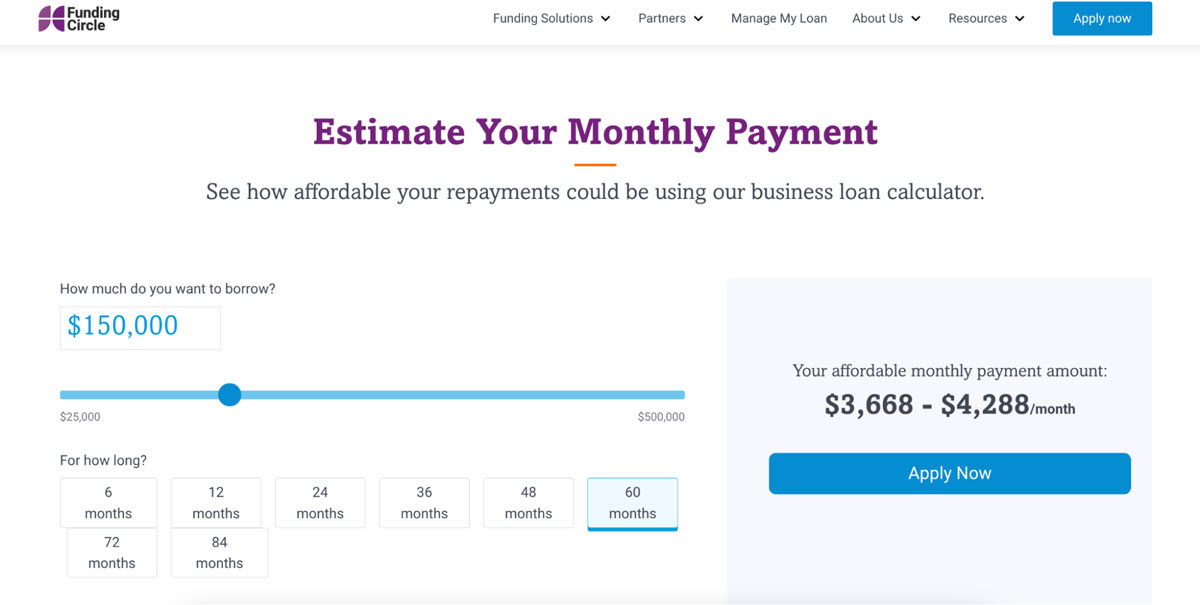

Funding Circle calculator helps you estimate your monthly payment. Source: Funding Circle website.

Typically, long-term loans require collateral, go through a longer approval process, and are processed through a traditional bank. Fortunately, Funding Circle bridges this gap and provides long-term loans – up to 84 months without collateral within a two-day approval process.

Funding Circle does require a slightly higher credit score of 660 than its competitors and two years in business to apply. That said, a minimum annual income requirement is not needed. Interest rates are fixed throughout the lifespan of the loan and there is a one time Funding Circle origination fee that ranges between 4.49 percent and 8.49 percent of the loan amount.

Users simply rave about the Funding Circle customer support. Users are impressed with how friendly, responsive, and helpful they are. Many customers say they work with Funding Circle every time because they are so pleasant to work with and truly make the process quick and smooth.

Is Funding Circle legit?

Funding Circle was founded in 2010 to bridge the financing gap and help small businesses have easier access to funding when needed. Since its inception, Funding Circle has helped over 135K small businesses in over 700 industries worldwide get over $20.2B financed.

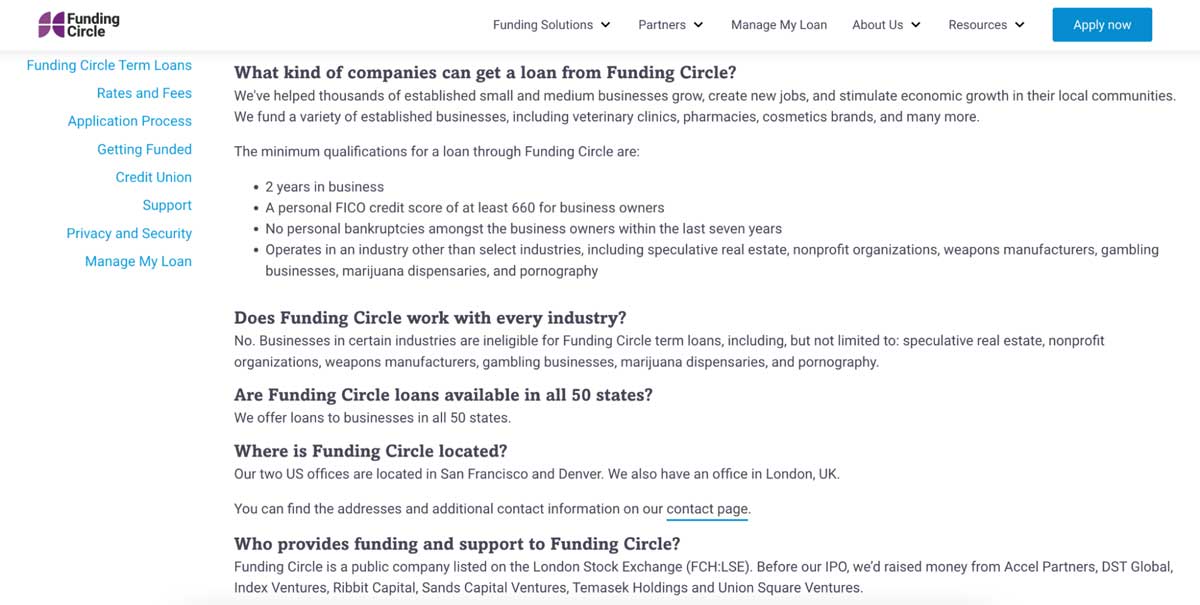

Funding Circle does not fund certain types of companies such as non-profits, gambling, and marijuana companies. Source: Funding Circle FAQs.

Funding Circle requirements

Funding Circle loans require at least 24 months in business to qualify.

- Time in business:

- 24 months

- Annual Revenue:

- None

- Credit Score:

- 660

| Funding Circle Lender Details | ||

|---|---|---|

| Loan Amounts | Time to Funding | Repayment Terms |

| Up to $500k | 48 hours | 84 months |

What does Funding Circle offer?

| Business Loan Types | |

|---|---|

| Term loan | |

| SBA loan | |

| Line of credit | |

| Invoice financing (through a lending partner) | |

| Working capital loan (through a lending partner) | |

| Merchant cash advance (through a lending partner) | |

| Equipment financing | |

Other notable Funding Circle features

- No prepayment Funding Circle fees

- Knowledge base for small business financing

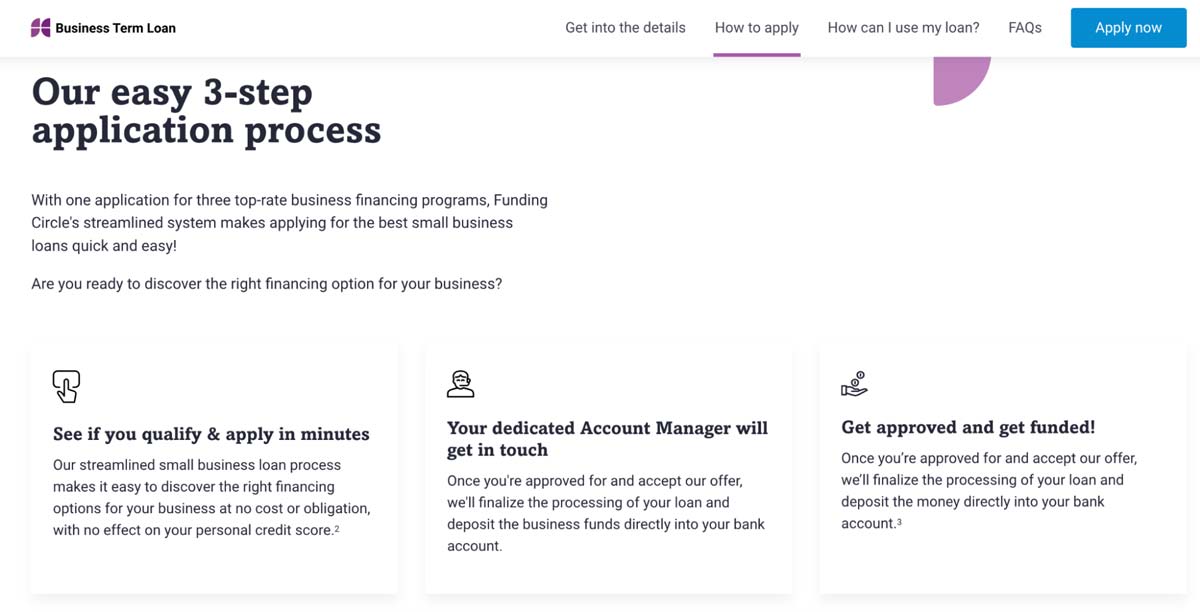

Funding Circle application process

Funding Circle has a simple and fast application process. Source: Funding Circle website.

You will need the following information to apply for a Funding Circle business loan:

- Business tax ID

- Names of anyone with over 20% ownership

- Social security numbers for all owners

- Drivers license number and state of issue for all owners

- Last two years of business tax returns

- Last year of personal tax returns for every owner

- Bank statements from the past six months

Funding Circle Customer Support

| Funding Circle Phone Number (new customers) | 855-385-5356 | |

| Funding Circle Phone Number (existing customers) | Not available | |

| Customer Support Email | loanquestions@fundingcircle.com | |

| Chat | Not available | |

| FAQs | Available | |

| Merchant cash advance (through a lending partner) | Available |

Funding Circle user review highlights

We analyzed 14,104 user reviews about Funding Circle from two third-party review websites to provide this summary.

Funding Circle gets a lot of positive feedback from users, with just a few complaints sprinkled in. Among the Funding Circle complaints are a few regarding potential customers getting far too much junk mail from the company and overly eager sales staff. But the more critical gripes suggest the Funding Circle interest rates are a bit high – which is not a good thing when it’s a fixed rate.

Another reviewer said the process took forever because the underwriters had to keep coming back to them for information on their company, and that Funding Circle didn’t seem to understand their industry.

Funding Circle scores extremely high with reviewers regarding a simple and easy application process. But the biggest perk of working with Funding Circle is the customer service.

Users love the support representatives, often referring to them by name in their reviews and gushing over how kind, helpful, and willing they are to go above and beyond. Still, other users report that Funding Circle is just a fantastic company to work with, and they consistently try to save users money.

- Application Process – Funding Circle reviews indicate that customers find the application process extremely easy and fast.

- Ease of Use – one Funding Circle review points out that it makes it easy for him to manage multiple loans for different businesses on one platform.

- Features – users appreciate how helpful and friendly the Funding Circle customer service representatives are.

- Quality of Support – Funding Circle scores extremely high with reviewers regarding customer service. Users love working with them and come back repeatedly because they are so nice and helpful and do everything possible to make it an easy and smooth loan process.

- Convenience – Funding Circle is conveniently fast when it comes to getting a long-term loan – something that would take a traditional lender weeks only takes Funding Circle two days at the most.

Funding Circle Contact Information

- Parent Company:

- Funding Circle

- Headquarters:

- Denver, CO

- Year Founded:

- 2010

- Website:

- www.fundingcircle.com/us/

- Facebook:

- facebook.com/FundingCircleUS/

- Twitter:

- twitter.com/FundingCircleUS/

- LinkedIn:

- linkedin.com/company/funding-circle-usa/

- Instagram:

- instagram.com/fundingcircleus/

- TikTok:

- tiktok.com/@fundingcircleus

- YouTube:

- youtube.com/channel/UCOD52xlde5wG8qMJNN_9YaA

Funding Circle alternatives

| Lender | Loan Amounts | B2B Reviews Score |

|---|---|---|

| Funding Circle | Up to $500K | 4.5 |

| Biz2Credit | Up to $2M | 4.8 |

| OnDeck | Up to $250k | 4.3 |