We may earn money when you click on links to our partners. Advertiser Disclosure

In light of recent bank failures, many American business owners may wonder if their funds are safe. To get a reading on their banking habits, we surveyed over 700 of them across multiple industries about where they bank and how they’d fare in a similar crisis. Our findings will help you understand the current risks as well as how (and if) businesses are preparing.

Key Takeaways

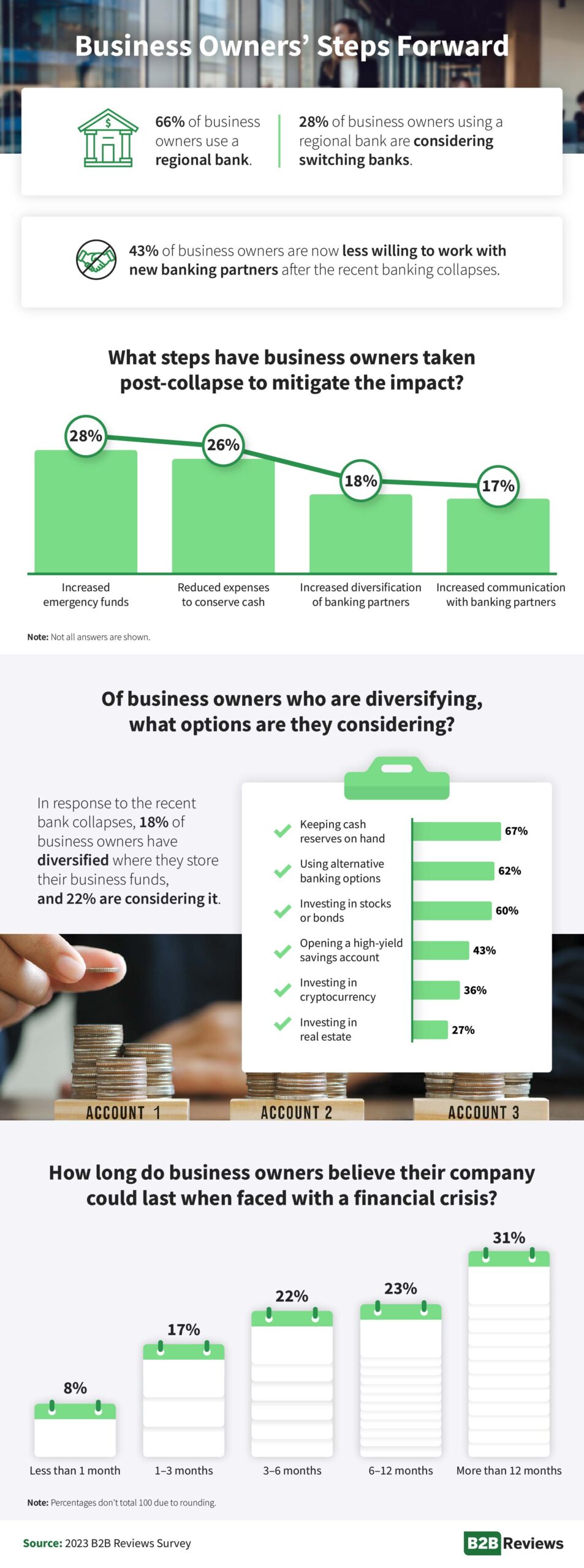

- Recent bank collapses have impacted nearly 1 in 15 business owners.

- Since these collapses, 43% of business owners are now less willing to work with new bank partners.

- The top 3 actions of the 18% of business owners who are diversifying are:

- Keeping cash reserves on hand (67%)

- Using alternative banking methods (62%)

- Investing in stocks and bonds (60%)

- The top 5 reasons business owners aren’t diversifying are:

- Happy with their current banking arrangements (68%)

- Believe recent bank collapses are isolated incidents (22%)

- Funds already diversified (21%)

- Don’t know of or understand alternative options (18%)

- Concerns about the safety or security of alternative options (14%)

- 31% of business owners believe they would last more than a year if faced with a financial crisis, followed by 23% who said they’d last 6-12 months.

- Percentage of business owners who said they would only last three months or less if they faced a financial crisis, by industry:

- Hospitality: 36%

- Education: 29%

- Health care: 27%

- Retail: 25%

- Technology: 24%

- Real estate: 19%

Regional Banking

- 66% of business owners bank with a regional bank, but 28% of them are considering a switch.

- Real estate business owners were most likely to use a regional bank (75%) followed by technology business owners (73%).

- Percentage of business owners who bank with a regional bank, by industry:

- Real estate: 75%

- Technology: 73%

- Health care: 67%

- Hospitality: 64%

- Retail: 64%

- Education 62%

Key Takeaways

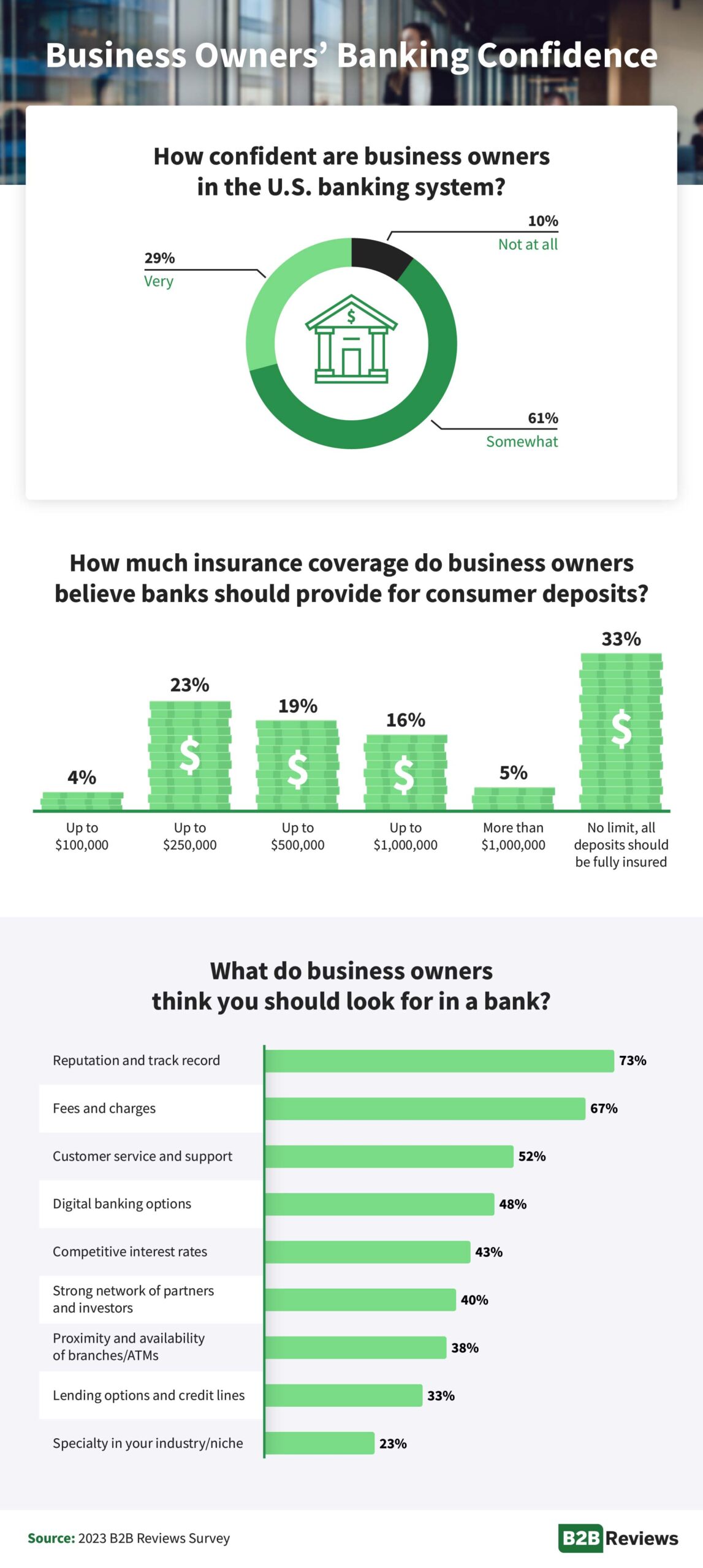

- 61% of American business owners are somewhat confident in the U.S. banking system, while just 29% are very confident and 10% aren’t at all.

- One-third of business owners believe bank customers’ deposits should be fully insured with no limits.

-

When choosing a bank, business owners’ top 3 recommendations are:

- To look for a bank with a strong reputation and track record (73%)

- To consider the fees and charges (67%)

- To consider the level of service and support (52%)

Preparedness and Backup Plans

-

56% of business owners said they feel prepared to face another financial emergency, while 44% do not.

-

Percentage who do not feel prepared, by industry:

- Hospitality: 61%

- Retail: 50%

- Education: 40%

- Health care: 36%

- Technology: 34%

- Real estate: 22%

-

Percentage who do not feel prepared, by industry:

-

63% of business owners have a financial backup plan in place in case of emergencies, but 37% do not.

-

Percentage who do not have a backup plan, by industry:

- Hospitality: 42%

- Retail: 41%

- Health care: 39%

- Technology: 28%

- Education: 26%

- Real estate: 16%

-

Of business owners who have a financial backup plan, their main reasons are:

- Protecting against unexpected expenses (68%)

- Preparing for a financial crisis (57%)

- Weathering seasonal fluctuations in revenue (32%)

- Maintaining business continuity during economic downturns (31%)

- Seizing investment opportunities (21%)

- Funding future growth initiatives (20%)

- Paying for equipment or infrastructure (13%)

-

These backup plans include the following:

- Emergency savings account (77%)

- Personal savings account (51%)

- Selling assets or investments (45%)

- Investment portfolio (37%)

- Line of credit (35%)

- Insurance policies (23%)

- Crowdfunding or seeking investor funding (6%)

-

Percentage who do not have a backup plan, by industry:

Methodology

B2B Reviews surveyed 725 business owners about the recent bank collapses. By industry, 23% were in retail, 19% were in technology, 6% were in education, 5% were in hospitality, 5% were in health care, 5% were in real estate, and the rest were in a different industry. As for business size, 65% were micro-business owners (less than 10 employees), 13% were small-business owners, 10% were mid-sized business owners, and the remaining 12% owned large businesses.

About B2B Reviews

At B2B Reviews, we pride ourselves on being a trusted resource for businesses seeking valuable insights on various industries, providing expert analysis, and empowering decision-making through comprehensive evaluations that cover a wide range of topics, including business loans and beyond.

Fair Use Statement

If you’d like to share our findings with other businesses or for any other non-commercial purpose, please include a link to this research.

Related Articles

Tech Workers’ Journey Post-Layoff

Best and Worst States for Business Loans