We may earn money when you click on links to our partners. Advertiser Disclosure

If there’s one struggle all small business owners face, it’s getting funding. Money is essential for business operations, paying employees, and covering bills. Unfortunately, cash flow is not not always reliable or consistent. That’s where business loans come in. But is it easier for small businesses to get funding in some states than others?

More populous states like New York, California, and Texas aren’t the only great places for small businesses to find funding. Smaller states, though they influence a smaller portion of the financial industry, are quite effective at supporting their small businesses through lending.

Our report focused on the three types of SBA loans (7(a), 504, and Microloans). While SBA loans are not the only funding option for small businesses, and not all businesses will qualify, the data available on SBA loans give us a good indication of the business lending environment in each state.

It’s important to note that small businesses must meet strict guidelines to qualify for any of these loans, and seeking alternatives is a good place for small businesses to start.

To help small business owners find the best states for business loans, we compared all 50 states and the District of Columbia across 12 key metrics and considered general business growth and health in each state. For a more in-depth look into how we determined our rankings, take a look at our methodology.

Key Findings

- Unsurprisingly, California and Florida had the highest approval counts and amounts for 504 loans.

- California accounted for 23.3% of 504 funds approved nationwide in the 2023 fiscal year, despite only having about 12.3% of small businesses in the US.

- Ohio approved the most microloans but had the smallest average microloan size.

- Alaska has the fewest small businesses but did well with its 62.1% business survival rate and larger average loan sizes per approval amount.

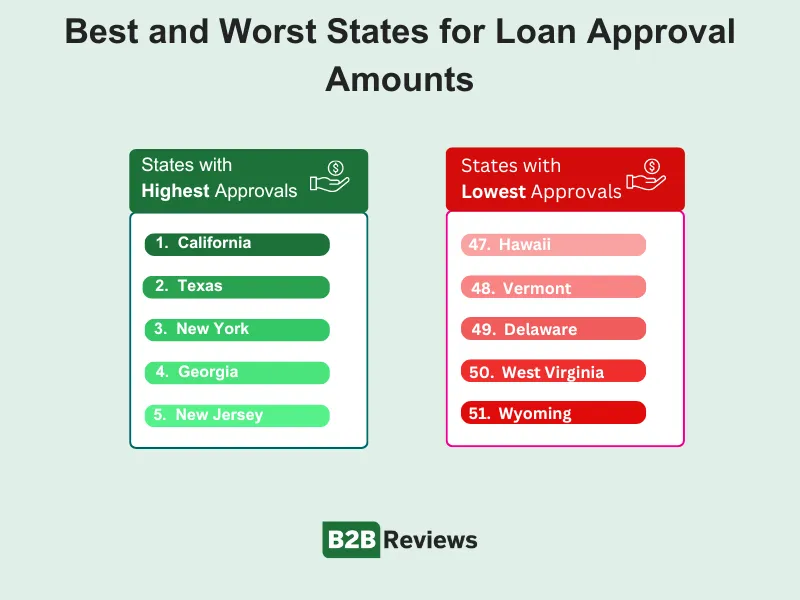

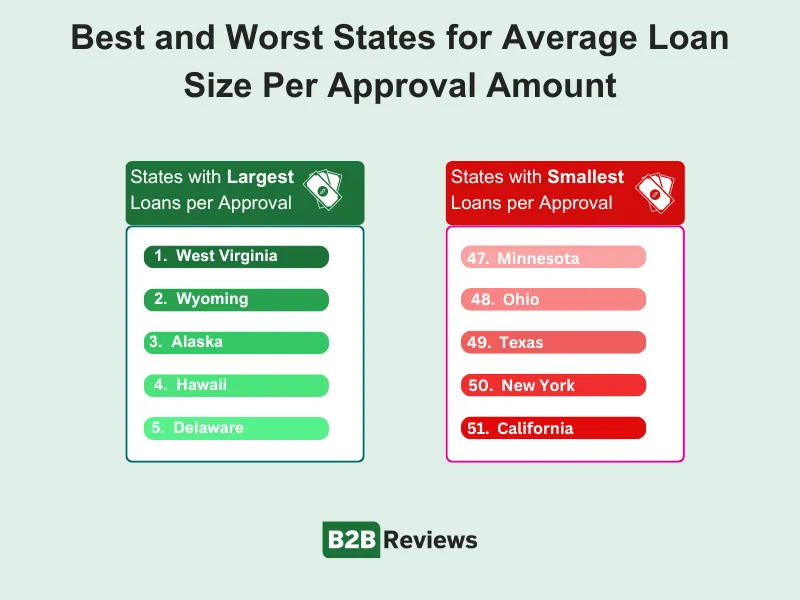

- West Virginia had the highest average loan size per approval amount across all loan types but had fewer loan approvals than other states.

Best States for Business Loans

Sort this chart to see where your state ranks overall or by category.

Total score reflects weighted points earned out of 100.

Methodology

Our research team compared SBA loan data for 7(a) loans, 504 loans, and Microloans for all 50 states and the District of Columbia across 12 key metrics to determine which states are most effective at supporting small businesses through lending. Their corresponding weights are listed below.

We used data from the SBA and the Census Bureau to find SBA loan approval amounts for each state and the average size of each loan. States with larger approval amounts and average loan sizes earned more points. We then divided the average loan size by the corresponding approval amount to find the percentage rate for each state. A higher percentage earned more points.

Our research team also examined small business health and growth factors, as business owners might want to consider the business landscape of the state where they apply for a loan.

States were ranked within each metric, earning a score based on the weighted value. They were then graded on a 100-point scale, with 100 points representing the states most effective at supporting small businesses with business loans.

Loan Approval Amounts - Total 27 Points

This category ranks the amount of money banks lent small businesses in the 2023 fiscal year.

- 7(a) Loans (9 points)

- 504 Loans (9 points)

- Microloans (9 points)

Average Loan Size - Total 27 Points

This category ranks the average loan size in each state for the 2023 fiscal year.

- 7(a) Loans (9 points)

- 504 Loans (9 points)

- Microloans (9 points)

Percent of Average per Approval Amounts - Total 30 Points

This category ranks the percentage of the average loan size per approval amount.

- 7(a) Loans (10 points)

- 504 Loans (10 points)

- Microloans (10 points)

Business Growth & Survival - Total 16 Points

This category ranks the states based on growth rates, number of businesses per capita, and business survival rates.

- Business growth rate (5 points)

- Number of Businesses Per Capita (5 points)

- Normalized for population based on the latest data from the US Census Bureau.

- Survival rates (6 points)

Lucienne Thomasi Jawo, MBA, a Finance Expert and President of JT Commercial Capital, says that “business owners [need] to be prepared before seeking a loan by knowing their personal credit score and business financials.” She also says that you will need to know how much money you need, what the money is used for, and how you’ll pay it back.

"Preparation and being informed is the key. Compare interest rates and ensure the loan is affordable to be paid back under the lender requirements, and be aware of the business trends such as the market conditions as lenders will consider stability and growth potential of your industry."

The SBA guarantees lenders a certain amount of money, helping them provide small businesses with financial assistance more confidently. However, each type has a different purpose, and small businesses must meet the requirements for the loan they are applying for. You can read more about the SBA loan types to see which one is best suited for your needs.

The Bottom Line

SBA loans are a useful resource that small businesses can take advantage of. However, some states are better than others for getting funding. Luckily, business owners don’t have to be in a larger state to secure good funding.

While SBA loans are not the only funding option for businesses, they offer insight into the lending landscape in each state. You can use our findings to get an understanding of how effective each state is at business lending, even if you’re looking into alternative business loan options.

Fair Use Statement

Feel free to share our findings with others so they can see how their state ranked in this new report. You can also share this for noncommercial purposes, but we ask that you provide a link back to this page so readers can access our full research and findings.

Data used to create our rankings were collected from the following sources:

- Small Business Administration. “7(a) & 504 Lender Report.” Accessed May 31st, 2024.

- Small Business Administration. “Microloans Lender Report.” Accessed May 31st, 2024.

- Small Business Administration: Office of Advocacy. “2023 Small Business Profiles for the States, Territories, and Nation.” Accessed May 31st, 2024.

- United States Census Bureau. “Total Population.” Accessed May 31st, 2024.