We may earn money when you click on links to our partners. Advertiser Disclosure

Effective accounting is crucial for financial health and growth in the always-changing world of small businesses. Understanding the latest small business accounting statistics provides valuable insight into current trends, challenges, and opportunities.

The following statistics reveal how small businesses adapt to a rapidly changing financial landscape, from the rise of automation and cloud-based software to shifts in remote work and accounting practices. In this article, we collected critical data points illuminating the current state of small business accounting and highlighted the essential tools and trends shaping its future.

Key Takeaways

- The accounting market is projected to grow to $735.94 billion by 2025.

- 62% of small businesses employ in-house accountants.

- 94% of accountants use cloud accounting solutions.

- Approximately 130,800 job openings for accountants are expected annually over the next decade.

- As the pandemic winds down, 81% of companies anticipate a significant increase in remote work.

The State of Small Business Accounting

Small and medium-sized business owners often report they lack bookkeeping knowledge. To be more specific, 21% of small business owners admit to not knowing enough about bookkeeping and nearly 70% of small businesses operate without an accountant.

- Accounting services cost between $20 and $100 per hour for small businesses.

- Limited financial literacy results in an average profit loss of $118,121 for small business owners which 42% of these owners admit to limited or no financial literacy before starting their business.

- 34% of small business owners handle their company’s bookkeeping responsibilities themselves.

- 82% of small businesses fail as a result of inadequate cash flow management.

How many small businesses use accountants?

- In-house accountants are employed by 62% of small businesses.

- Meanwhile, 30% of small business owners opt for external accountants.

- 8.64% of business owners handle their own bookkeeping, whereas 64.4% rely on accounting software.

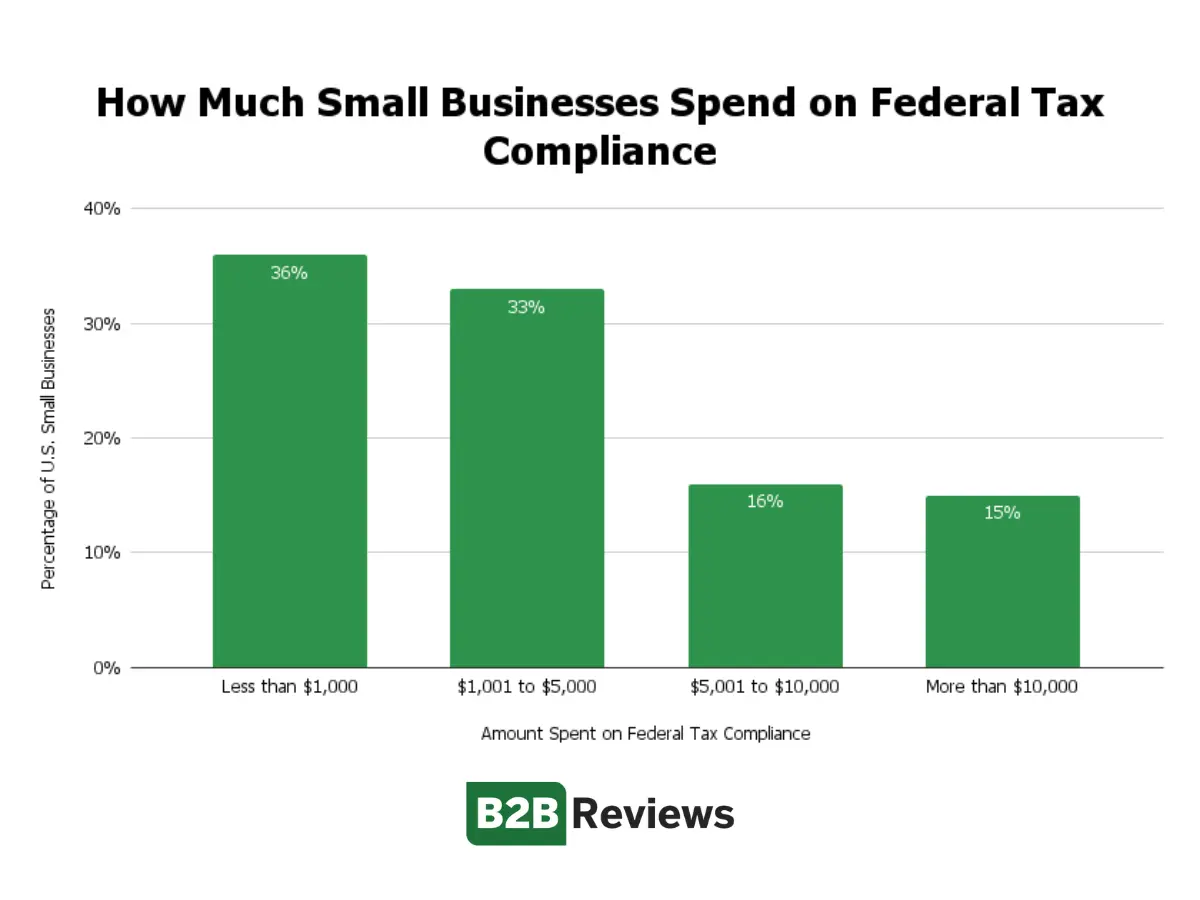

How much do small businesses spend on federal tax compliance?

31% of small businesses in the U.S. spend over $5,000 annually in federal tax administration costs. Meanwhile, just 15% of these businesses report spending more than $10,000 on managing their federal taxes. The chart below shows how much money small businesses spend on their federal taxes:

General Accounting Statistics

Accounting serves as the foundation for all businesses, regardless of the size of the business. This includes overseeing accounts payable, accounts receivable, cash flow, and taxes. Small business owners usually take on these responsibilities when they are first starting out.

As businesses expand, the responsibilities that bookkeeping calls for are increasingly overwhelming. This often leads many small businesses to seek outsourced accounting services, which allows their team members to focus more on their core responsibilities and boosts overall efficiency and productivity.

- In 2020, the global market value for accounting services reached $544.06 billion.

- The market is projected to grow to $735.94 billion by 2025.

- 90% of accountants globally feel that there has been a cultural transformation in the field of accountancy.

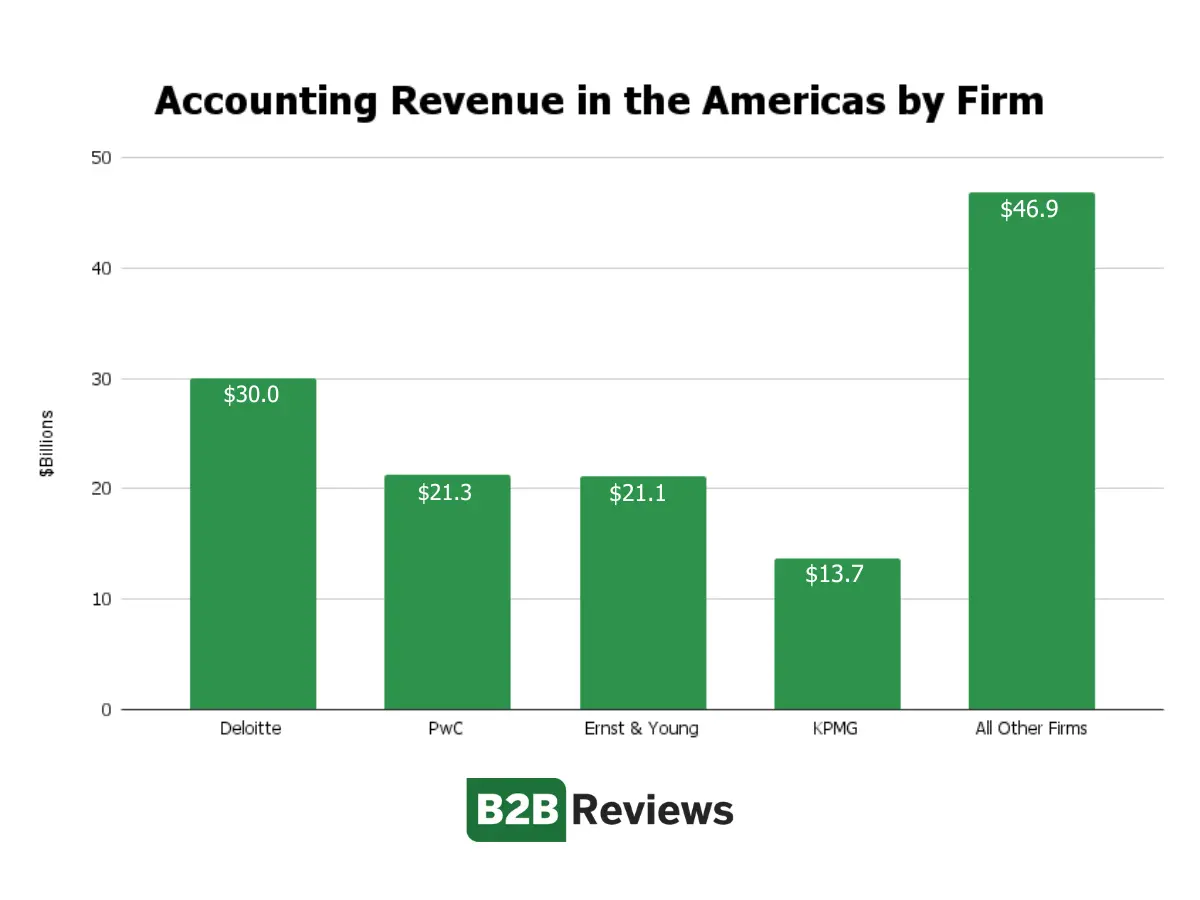

According to an Accounting Today survey from 2022, 51% of accounting firms consider staying updated with regulatory changes as their greatest challenge. Other interesting stats around accounting firms in America include:

- Accounting firms in the U.S. generated $133 billion in revenue in 2022.

- Nearly 65% ($86 billion) of this revenue was generated by the four largest accounting firms in the country.

Technology Trends in Accounting

Automation advances in accounting leads to more efficient use of technology and quicker business decision-making. The incorporation of AI into accounting software enables automated data categorization and entry.

94% of large firms and 90% of small firms are adopting technology to boost efficiency during tax season, aiming for better processes and results. Accounting professionals acknowledge that technology enhances productivity, saves time, and allows them to focus more on customer service.

- 43% of accounting firms are either reducing their physical office spaces or shifting to a fully virtual setup.

- While 91% of firms agree that technology helps them focus on client needs and boost productivity, only a small fraction (7%) believe they are fully maximizing their existing technology.

- 94% of accountants use cloud-based accounting software.

- Businesses that use cloud accounting systems attract five times as many customers and see significant cost reductions compared to those relying on traditional systems.

In the U.S., companies are grappling with a shortage of skilled employees and elevated turnover rates, driven primarily by pandemic-related burnout and changing career preferences.

Accounting firms that utilize cloud accounting solutions can now expand their reach which attracts talent and clients from a wider geographic area.

On top of that, these solutions support workplace flexibility and promote a healthier work-life balance.

- In 2024, most tax returns were completed without direct in-office meetings with taxpayers, and audits saw a significant decrease in face-to-face client interactions.

- 81% of companies expect a moderate to substantial rise in remote work as the pandemic subsides.

Accounting Job Statistics

The employment of accountants and auditors is anticipated to increase by 6% from 2023 to 2033, which outpaces the average growth rate for all professions.

On average, approximately 130,800 job openings for accountants and auditors are expected annually over the next decade. These openings will largely stem from the need to fill positions vacated by workers transitioning to other careers or retiring.

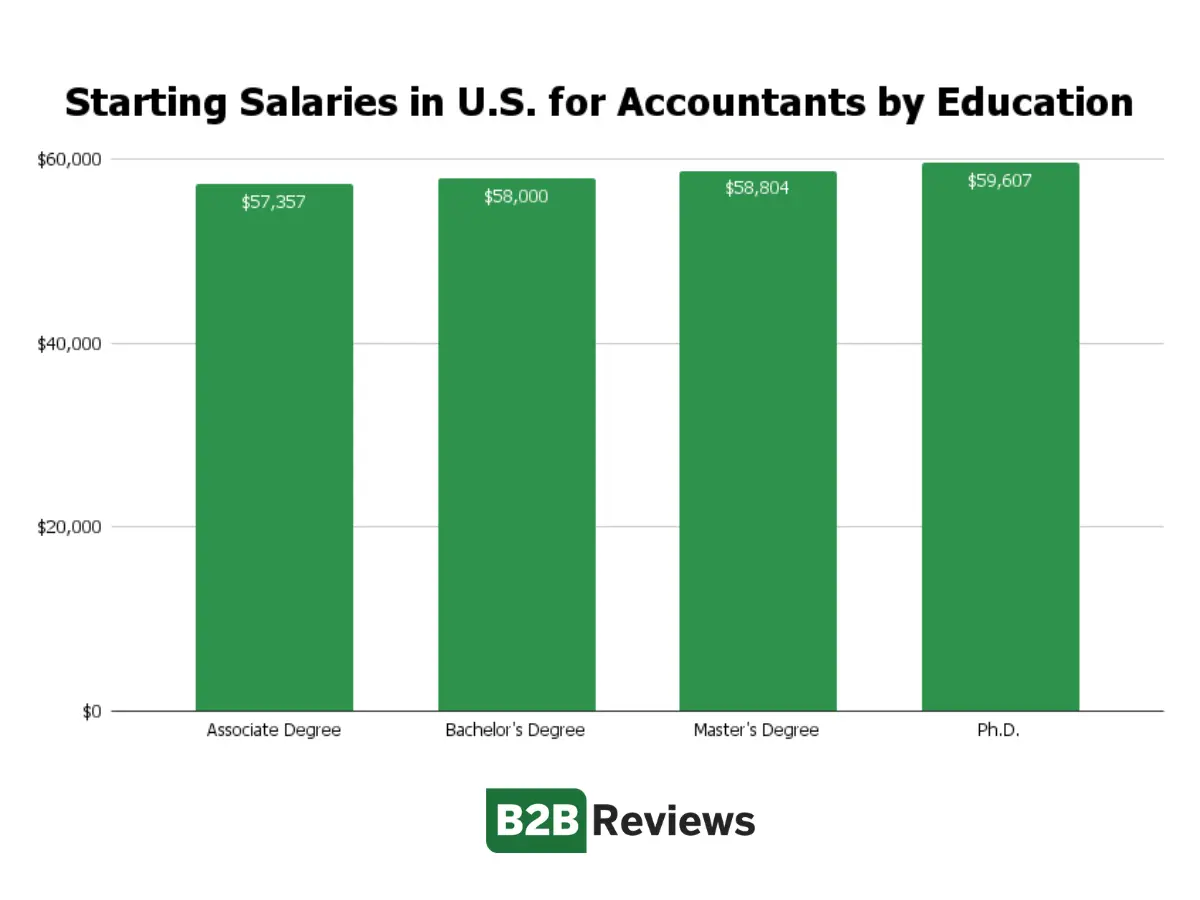

In the U.S., the starting salary for accountants is $60,009 and shows minimal variation based on education level. Interestingly, on average, accountants with a graduate degree earn just 4% more than those with an associate degree. The below chart shows the starting salaries in the U.S. for accountants with different degrees:

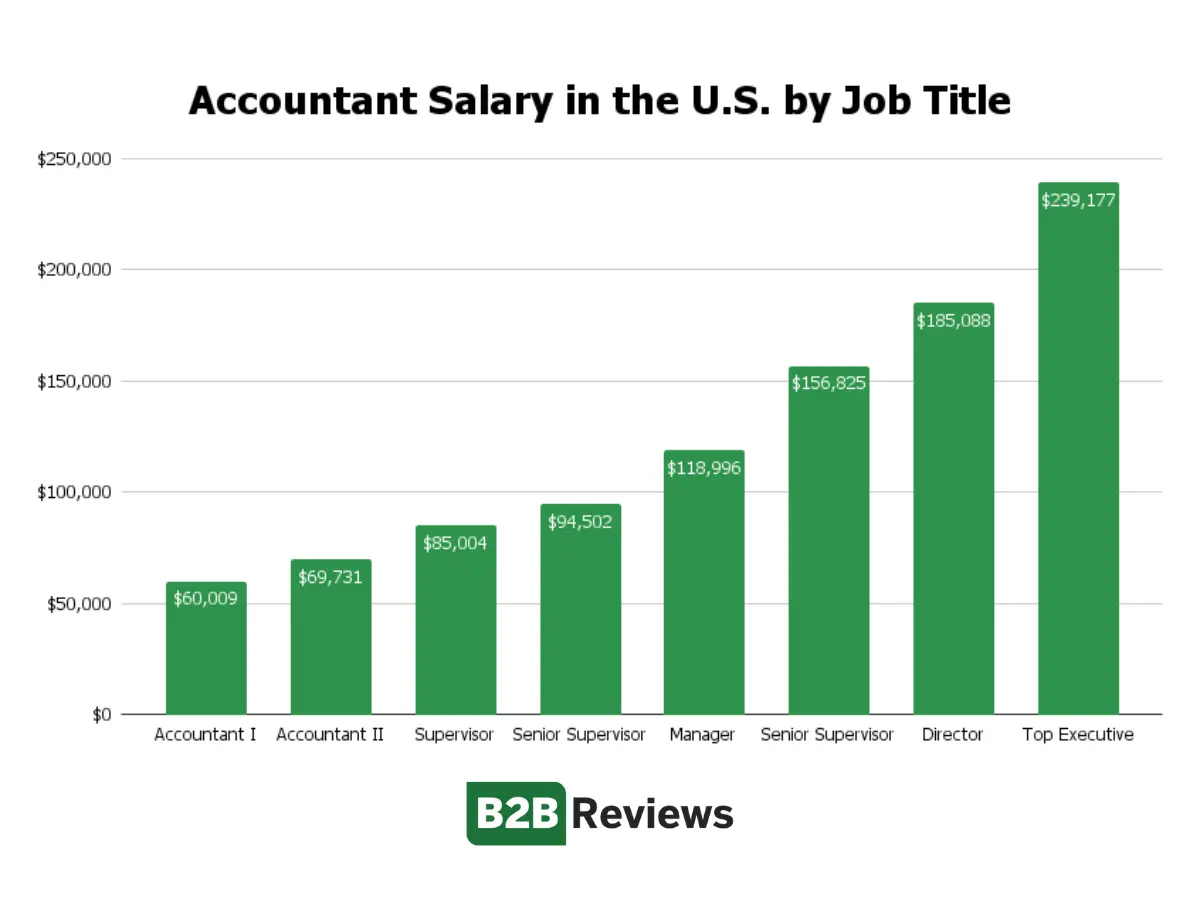

As per any job, accountants have significant potential for long-term salary growth as they progress in their careers. The following numbers represent the median earnings for accountants at various stages of their professional advancement:

Accounting Software Statistics

With the rise of remote work and the growing need for access to information anytime, the accounting software industry is progressively moving towards cloud-based solutions. Research and Markets projects the global accounting software market will reach a value of $735.94 billion by 2025.

- Nearly 75% of accounting tasks can be automated through accounting software.

- Given the complexity and time required for accurate accounting, U.S. statistics indicate that software can handle almost 75% of these tasks automatically.

- 38% of businesses that do not use accounting software cite security concerns as their primary reason.

- In the U.S., Intuit Quickbooks stands out as the most recognized accounting software, with more than 70% of business owners either familiar with the brand or having used it.

Small Business Accounting Services Statistics and Trends

In today’s digital era, technology literacy is the most crucial additional skill for accountants. 29% of automated technology is utilized within the accounting world. Current statistics show that a significant portion of automation technology is dedicated to accounting functions, and 50% of all accounting tasks can now be performed using available technologies.

Beyond an eye for talent and attention to detail, modern accountants need to excel in several areas:

- Technology literacy

- Relationship building

- Business advisory

- Industry-specific experience

- Project management

Forensic Accounting Statistics

While accounting might appear to be a less dynamic field, the realm of forensic accounting, which focuses on fraud investigation, reveals some intriguing insights. Some interesting facts about forensic accounting include

- There are 37,596 forensic accountants employed in the U.S.

- The average nationwide salary for forensic accountants is $86,267, with a starting salary of around $50,500 and more experienced professionals earning over $133,000.

- From 2020 to 2025, employment in the Forensic Accounting Services Industry in the U.S. grew at an average rate of 2.9% per year.

- In 2024, the Forensic Accounting Services Industry had a market size of $9 billion in revenue.

- The states with the highest number of forensic accounting services businesses are California with 7,343 businesses, Florida with 4,489 businesses, and Texas with 4,207 businesses.

Accounts Payable Statistics

Managing Accounts Payable can often appear as a tedious job due to the need to monitor numerous bills and payments. However, both accounts payable and receivable have evolved substantially in recent years. What was once just manual invoice processing is now a crucial component of strategic business development.

- 84% of vendors prioritize the speed of payment above all other aspects of their customers’ payment systems.

- The investment in accounts payable software typically pays for itself within 6 to 18 months, even though it can be a considerable expense, especially for small businesses.

- Accounts payable software can reduce costs by $16 or more per invoice.

Bottom Line

The evolution of small business accounting is driven by advancements in technology and changes in work patterns. With the adoption of accounting software, there is a notable impact on the efficiency and accuracy of financial management.

Technology trends in accounting, including cloud-based solutions, are reshaping the landscape which makes it easier for small business owners to manage their finances from anywhere.

As remote work continues to gain traction, the flexibility offered is crucial for maintaining productivity. Overall, the integration of advanced accounting software and technology is transforming the accounting profession, enhancing efficiency, and opening new avenues for career development.

- Rigits. “14 Bookkeeping Statistics You Need to Know” Accessed September 9, 2024.

- GoRemotely. “37 Amazing Accounting Statistics Showing the Power of Numbers.” Accessed September 9, 2024.

- Intuit Quickbooks. “20 Small Business Financial Literacy Statistics to Know in 2024.” Accessed September 9, 2024.

- Fit Small Business. “28 Important Accounting Statistics by Actual Experts.” Accessed September 9, 2024.

- First Research. “Payroll Services Industry Profile.” Accessed September 9, 2024.

- FitSmallBusiness. “12 Payroll Statistics You Need to Know in 2023 (+ FAQs).” Accessed September 9, 2024.

- Escalon. “Accounting Statistics for Small Businesses: A Roundup.” Accessed September 9, 2024.

- ContentSnare. “47 Accounting Industry Statistics You Should Know.” Accessed September 9, 2024.

- Ace Cloud Hosting. “92 Top Accounting Statistics & Facts for 2024.” Accessed September 9, 2024.

- U.S. Bureau of Labor Statistics. “Accountants and Auditors.” Accessed September 9, 2024.

- DocuClipper. “51 Accounting and Bookkeeping Statistics for 2024.” Accessed September 9, 2024.