What is Baselane?

Baselane is a new financial platform created for DIY landlords and real estate investors with an easy-to-use solution to monitor rental income, property costs, and financial reporting all in one place. Its strongest feature is the capacity to combine real estate accounting, online rent collection, and banking into its fully verticalized system that simplifies property finances without clunky spreadsheets or third-party software.

Get Started For Free Visit Baselane’s website

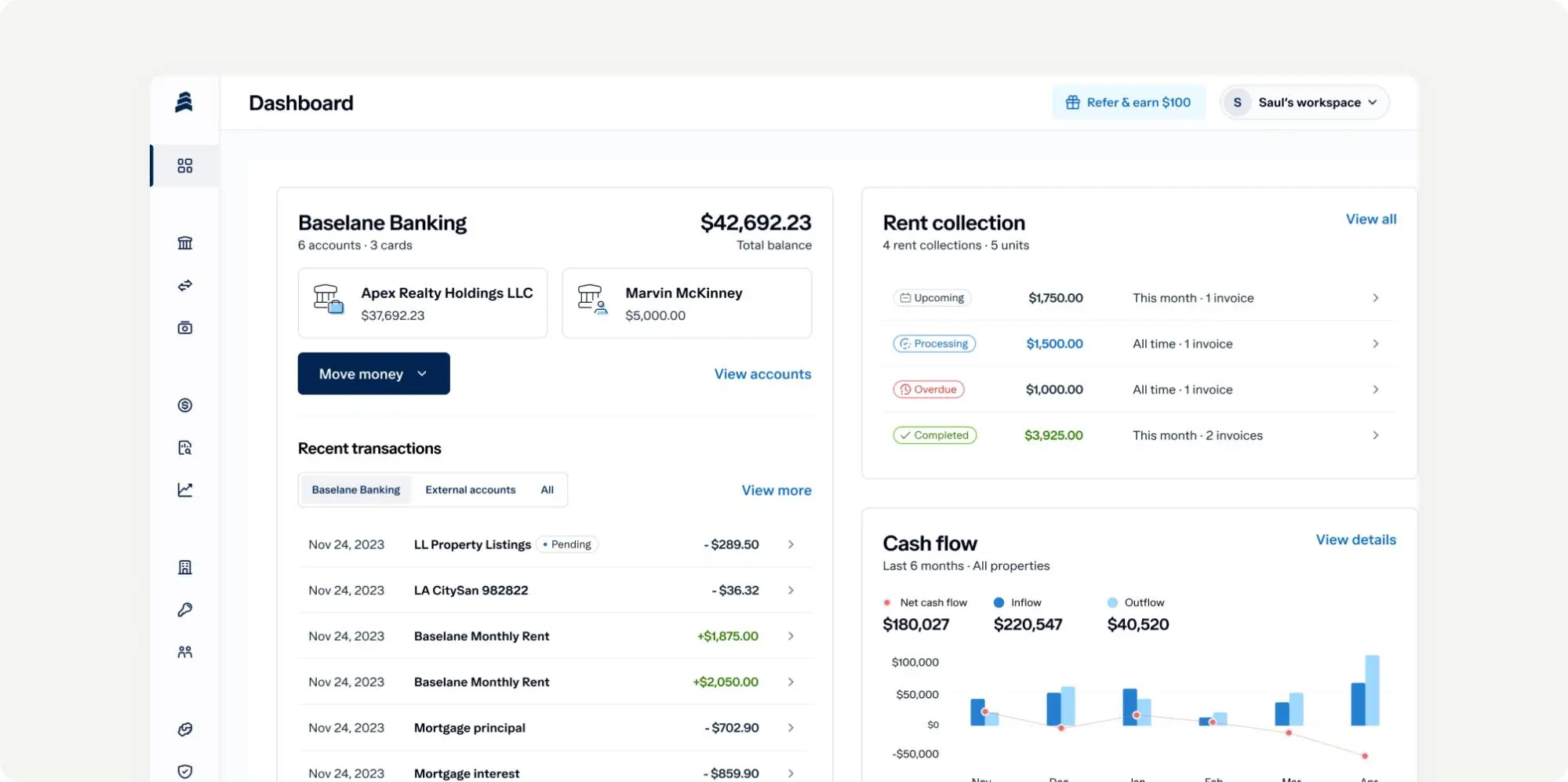

Baselane dashboard.

The platform also has robust accounting features such as automatic tracking of expenses and revenues for renters, smart transaction categorization, and real-time financial dashboards that allow users to monitor property performance. The platform also has a free ACH and card payment rent collection feature and automatic reminders and scheduling to help reduce delayed payments.

In addition to its core accounting tools, Baselane has built-in banking with FDIC-insured accounts so tenants can split rental income by property, earn interest, and make payments directly from the app. While Baselane does not contain deep property management features such as maintenance tracking or lease storage, it does a great job of keeping finances tidy and cash flow transparent.

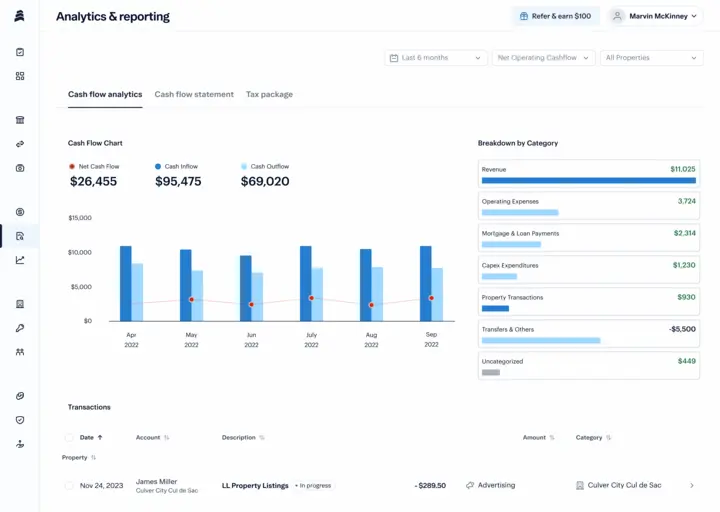

Baselane analytics and reporting page.

Baselane is ideal for real estate investment, with clear visibility into real estate performance and tax-ready reports. Its simplicity and no-cost pricing structure ensure it’s a hassle-free choice for landlord banking holding a few properties or scaling a rental portfolio. With built-in banking and rent collection, it’s a money command center for property owners wanting to simplify processes and optimize gains.

Get Started For Free Visit Baselane’s website

Is Baselane legit?

Baselane is a legitimate and trusted platform backed by industry professionals with deep experience in finance, technology, and real estate. Since its launch, Baselane has positioned itself as a forward-thinking solution for landlords and real estate investors looking to simplify financial management. The company is based in the U.S. and has earned a solid reputation for its user-friendly design, responsive customer support, and security-focused banking features, including FDIC-insured accounts through its banking partners.

Baselane is frequently featured in real estate and fintech publications and is praised for its transparency, zero monthly fees for core tools, and practical features that serve the real-world needs of independent landlords. With a growing user base and a commitment to continuous improvement, Baselane delivers on its promise to streamline rental finances with tools tailored specifically for property owners—not general business software.

How much does Baselane cost?

Baselane doesn’t have prices for their plans, but has small fees.

- Starting price:

- Varies

- Free trial:

- None

- Free version:

- Available

| Baselane Pricing & Plans | ||

|---|---|---|

| Banking | Rent Collection | Bookkeeping & Accounting |

| $2 per mailed check & $15 per checkbook | $2 via ACH if deposited into an external bank OR $0 via ACH if deposited into a Baselane banking account and 3.49% via card (charged to tenant) | Free |

| Unlimited banking accounts for all entity types | Automated invoices for rent, fees, and security deposits | All transactions synced in one place |

Get Started For Free Visit Baselane’s website

What’s included in every Baselane plan?

Baselane’s free core platform features fundamental tools such as rent collection, auto-pay, automatic income and expense tracking, real estate-specific reports, and FDIC-insured banking. Unlimited properties can be managed, financial dashboards can be accessed, and tax prep can be streamlined—all without a monthly fee. Optional paid add-ons include mailed checks and premium payment processing.

Which features does Baselane offer?

| Real Estate Accounting Software Features | |

|---|---|

| General Ledger & Core Accounting | |

| Payment Processing & Invoicing | |

| Reporting & Analytics | |

| Platform Management & Customization | |

| Integration & Data Management | |

Other notable Baselane features

- Automated rent collection with late fee settings

- Real estate-specific banking with virtual accounts

- Rental property performance dashboards

- Tax-ready financial reports

- Secure document storage and receipt scanning

- Built-in tenant screening tools

What types of support does Baselane offer?

| Data Migration | |

| 1-on-1 Live Training | |

| Self-Guided Online Training | |

| Knowledge Base | |

| FAQs/Forum | |

| Email Support | |

| Live Chat | |

| Phone Support |

Get Started For Free Visit Baselane’s website

Baselane user review highlights

We analyzed 155 user reviews about Baselane from two third-party review websites to provide this summary.

Baselane receives glowing praise and serious concern from customers, painting a nuanced picture of its real estate accounting and banking platform. Many landlords—especially first-time and small-scale property owners—appreciate its free plan, clean interface, and all-in-one tools that simplify Baselane’s rent collection, financial tracking, and tenant communication. Several users highlight the ease of setup, intuitive dashboards, and valuable features like digital accounts per property and competitive interest in reserve funds. Customer support has also left a strong impression, with users calling their experiences “superb” and “a true pleasure.”

However, not all experiences have been positive. A few customers have faced frustrating account issues, particularly around frozen funds and long response times from support. Some noted transaction delays, difficulty reaching live assistance, and confusion around certain app functionalities. Despite these drawbacks, many customers still express strong satisfaction with the platform overall and recommend it for its affordability, comprehensive features, and ability to streamline rental property management.

- Ease of Setup – Customers consistently praise Baselane for its smooth onboarding process and fast setup. Many first-time landlords found it easy to get started, with helpful guidance from the support team making the initial experience welcoming and efficient.

- Ease of Use – Baselane’s minimalist interface and streamlined design make it easy to navigate, even for customers with limited accounting experience. While a few noted that certain functions (like expense splitting) could use better in-app guidance, most find the platform intuitive once familiarized.

- Features – The platform offers a wide range of tools that landlords find valuable, including digital property accounts, rent distribution, ACH transfers with no fees, and competitive interest on reserve funds. Some users mentioned room for improvement, like grace period tracking or mobile access.

- Quality of Support – Support experiences vary—some customers rave about responsive and knowledgeable help, especially through dedicated reps, while others report delayed responses and difficulty reaching live agents. Support is primarily email-based, with a slower turnaround for urgent issues.

- Value for Money – Baselane’s free pricing model and integrated banking features and property management software make it a strong value, especially for small landlords. Users appreciate that essential tools come at no cost and find the platform a budget-friendly alternative to traditional banks or paid software.

Baselane Contact Information

- Parent Company:

- Thread Bank, Member FDIC

- Headquarters:

- New York, NY

- Year Founded:

- 2020

- Website:

- baselane.com/

- Facebook:

- facebook.com/baselanehq/

- Instagram:

- instagram.com/baselanehq/

- Twitter (X):

- x.com/baselanehq

- LinkedIn:

- linkedin.com/company/baselane

- YouTube:

- youtube.com/@baselane